As experts in commercial real estate title insurance, we’re closely monitoring market trends that impact our clients. Recent data has revealed some significant shifts in the commercial property landscape:

- In 2023, the six largest U.S. banks reported a sharp increase in delinquent commercial property loans, reaching $9.3 billion – nearly triple the previous year’s figures.

- This rise is primarily attributed to high vacancy rates and escalating borrowing costs.

- The commercial real estate sector is now under increased regulatory scrutiny due to potential risks to overall bank stability.

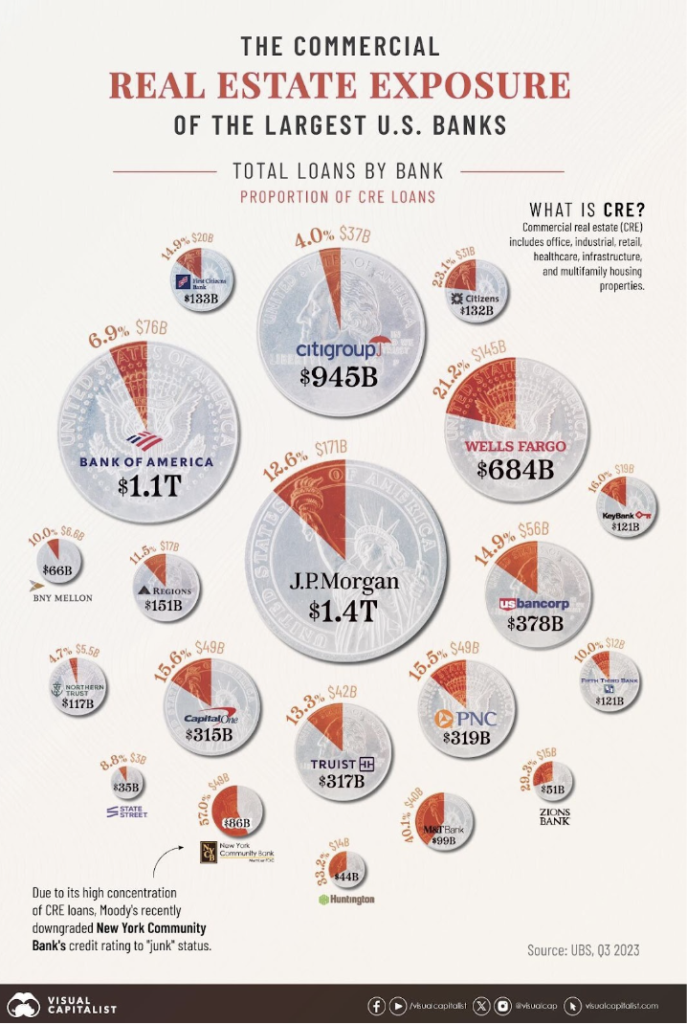

- Commercial real estate debt represents the most significant loan category for almost half of all U.S. banks.

- While smaller banks tend to have a higher concentration of commercial loans, several major financial institutions also hold substantial commercial loan portfolios.

These trends underscore the importance of robust risk management strategies in commercial real estate transactions. As your trusted title insurance partner, we’re committed to helping you navigate these challenges and protect your investments.